Do you have mortgage questions? We have answers

Contact the Customer Service Department

Existing Home Loans

New Home Loans and Refinancing

Home Office Address

Need a Log-in?

If you do not currently have a log-in to the My Account section of GuildMortgage.com, and you want to access your loan information online, then please register for a log-in: https://myaccount.guildmortgage.com/guild-home/my-account/login/Already have a Log-in?

If you already have a log-in to the My Account section, and you want to manage an additional loan using the same log-in, then:- Log in to your account. Log-in here.

- Click on the “Attach a Loan” option in the sub-navigation.

- Type in your 10-digit loan number in the “Add a Guild loan to your account” field.

- Click the yellow “Save Changes” button at the bottom of the screen.

- When the screen reloads, there should either be a bright green message declaring success, or a bright red error message with further instructions!

Property Tax Information

If you have an escrow account for taxes, you do not need to forward a copy of your regular tax bill to Guild Mortgage Company. If you received an adjusted or corrected tax bill, you may fax the bill to 858-492-5835 or mail it to the address below. Please note that we must receive the tax bill ten (10) business days prior to the delinquent date. If we are not given sufficient time to pay your corrected or adjusted tax bill, any penalty will be charged to your escrow account.

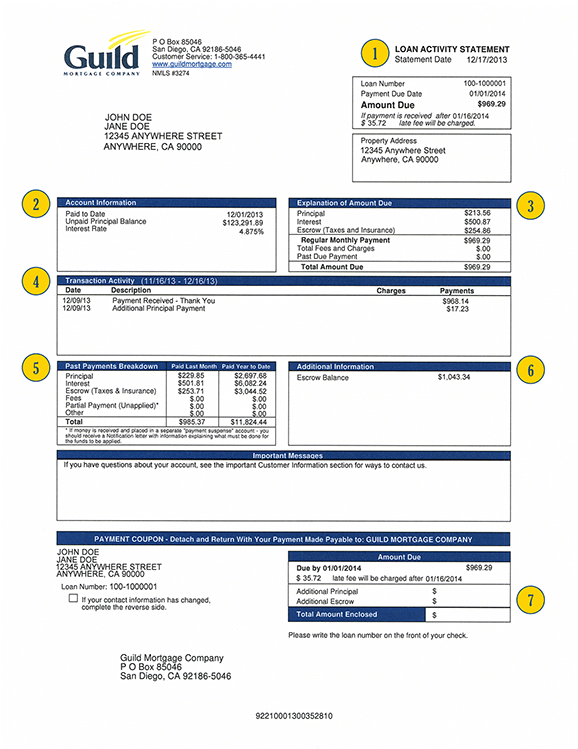

STATEMENT DATE | The date your statement is printed. Any payments or transaction activity after this date will not be shown.

Your Paid To Date is the date your loan’s interest is paid through. The Unpaid Principal Balance is the unpaid portion of the loan amount (this does not include interest). If your loan has been modified with a deferred principal balance, it will include the non-interest bearing deferred principal. If so, you will see the amount of deferred principal in the Additional Information box. The Interest Rate is the rate of interest charged on your loan. If your loan is an adjustable rate mortgage or a modified loan that will step up to a new interest rate, the next interest rate change date will be listed here.

This section includes payment information for the next scheduled Regular Monthly Payment and any past due fees and payments. Your Regular Monthly Payment is broken down to show how it will be allocated toward principal, interest, and escrow items. Any Fees and Charges such as previously assessed late fees or Non-Sufficient Funds (“NSF”) charges that remain unpaid and any past due payments are all included in the total Amount Due. Your Escrow includes the monthly amount currently due for the payment of taxes, insurance and Optional Personal Insurance, if applicable.

This section includes all transaction activity since your last Loan Activity Statement including any fees accessed. You will see disbursements made on your behalf from your escrow account as a negative number in the payments column and any payment received from you as a positive number.

This section includes the total of all payments received since your last Loan Activity Statement and how it was applied to principal, interest, escrow, fees and unapplied account, if applicable (Paid Last Month column). Also included is the total of all payments received since the beginning of the calendar year and the corresponding application to principal, interest, escrow, fees and the balance currently in unapplied, if applicable (Paid Year to Date column).

Your Escrow Balance is the current balance of your escrow account after any disbursements made on your behalf and any deposits made into your account.

You may elect to include extra money towards principal and extra money towards your escrow account. ACH Customers: With this Loan Activity Statement format beginning January 2014, we have turned paper statements back on. You may still opt out of receiving paper statements. To opt out after making sure you can view your statement on line go to the Account Settings.

Payment is made prior to the policy expiration date. This will be reflected on your monthly loan activity statement. If you are registered online your account page will reflect the last insurance payment. You can register here.

If you paid the premium to your new insurance company, and you received a refund from your old insurance company, then you can keep the refund check. If you did not pay the premium to your new insurance company, and if the new premium was paid from your escrow account, please call Customer Service at 800-365-4441 to speak with an agent to make a payment to your Escrow Account. You can also send a personal check for the refunded amount to be deposited into your escrow account to minimize any shortage. Please mail your check to:

Please view our Property Damage process for complete details. If you have additional questions, call Customer Service at 800-365-4441, Mon through Fri 5 a.m.to 5 p.m.

All hazard insurance premium renewals, replacement policies and evidence of insurance statements must be received 20 days prior to the expiration date of your existing policy to avoid any lapse in coverage. You can click here to access your insurance policy information, update evidence of insurance or submit new policy documentation quickly and easily. Alternatively, you can submit any documentation by email to: [email protected] or mail to the address below:

What fees are associated with servicing my loan?

The schedule below lists common fees that could be associated with servicing a loan. This is not a complete list and is to be used for informational purposes only.Common Servicing Fees

This fee schedule is provided for informational purposes. It outlines typical fees that could be assessed for servicing a mortgage loan.| Fee description | Fee amount | When fees may be charged |

| Assumption | $300-$2,400 | Fee charged upon approval of changing the individual(s) legally responsible for repaying the loan. |

| Foreclosure | Varies | Foreclosure Varies Fees associated with the foreclosure process. Those fees may include, but are not limited to, attorney services, publication costs and title report and searches. |

| Reconveyance fee | Varies | Fee for services required to release (reconvey) a lien. The fee is calculated according to the Deed of Trust or Mortgage. |

| Recording fee | Varies | A government fee assessed for legally recording the Deed of Trust or Mortgage and other documents related to the loan. The fee is determined by the county. |

| Tax Penalties | Varies | Any fees assessed, by the county, for delinquent taxes that are the borrower’s responsibility. |

| Amortization schedule | $ 0.00 | Providing a new amortization schedule other than the schedule provided at closing (second request). |

| Document request | $ 0.00 | Providing a copy of the mortgage note, deed of trust or other loan document that is a duplicate of what had already been provided at closing (second request). |

| Faxing Fee | $ 0.00 | Providing requested documents to borrowers by fax (second request). |

| Inactive file retrieval | $ 0.00 | Providing a copy of the mortgage note, deed of trust or other loan document that was provided at closing. |

| Insurance substitution | $ 0.00 | When customer substitutes new insurance policy in the middle of their policy term (second substitution). |

| Late charges | Varies | Fee for payment received after the 16th of the month. The fee is as determined on the Note and is based on the amount past due. |

| Loan history | $0.00 | Providing a payment history for time period before current year and one year prior (second request). |

| Non-sufficient funds | $15.00 | Fee for processing and/or reprocessing checks returned as uncollectable. Maximum as allowed by State. |

| Speedpay | Varies | The fee charged for making payment using any method through Speedpay, including automated phone payments, representative assisted payments and Guild website. Fee varies by state up to $7.00. |

| Year-end statement | $ 0.00 | Providing replacement statement (second request). |